In this blog, Tim Jackson introduces his new CUSP working paper ‘The Post-Growth Challenge’, in which he discusses the state of advanced economies ten years after the crisis. Our attempts to prop up an ailing capitalism have increased inequality, hindered ecological innovation and undermined stability, he argues.

–

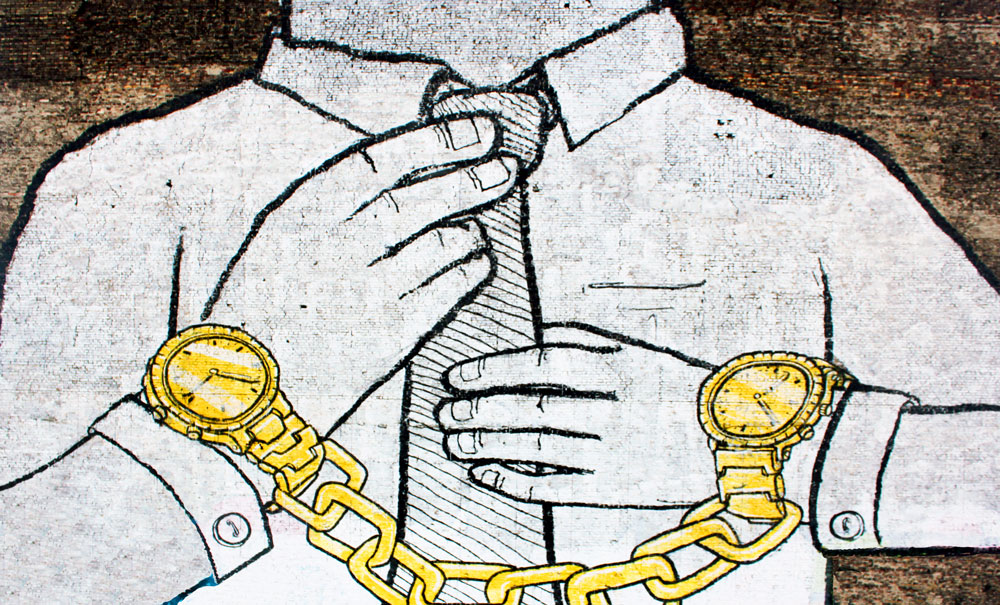

This week saw the launch of System Error a documentary film from the prize-winning German Director Florian Opitz, who has made something of a reputation for himself critiquing the flaws in 21st century capitalism. The film explores our obsession with economic growth through the testimony of some of its most vociferous advocates. It’s a fascinating insight into the ‘GDP fetish’ that has dominated economic policy for over sixty years despite long-standing critiques to the contrary. Opitz’s film is a testament to the tenacity of the growth paradigm – even half a century later.

If there’s one thing that might really throw a spanner in the works it’s that economic growth as we know it is slowly slipping away. Growth rates in advanced economies were declining already even before the crisis. The day after the film’s première in Berlin, former US treasury secretary, Larry Summers writing in the FT defended his contention (first advanced five years ago) that the growth rates expected by economists and yearned for by politicians may be a thing of the past. Sluggish growth, he has argued, is not simply the result of short-term debt overhang in the wake of the financial crisis but might just turn out to be the ‘new normal’. It’s an argument that has support, not only from other mainstream pundits, but also from national statistics: UK growth slumped to another five year low in the first quarter of 2018.

Most reactions to the absence of growth consist in trying to get it back again as fast as possible – whatever the cost. Low interest rates, cheap money, inward investment, bank bailouts, government stimulus, land-grabs, tax havens, fiscal austerity, customs partnerships – you name it. Some of these things didn’t even make sense when put together. But at least they divert us from an inconvenient truth: that the future might look very different from the past. Were it not for a climate destabilised by carbon emissions, oceans which will soon contain more plastic than fish and a planet reeling from species loss a thousand times faster than any at time in the last 65 million years, it might not matter that they don’t add up. But is throwing good money after bad (so to speak) an effective strategy, even in its own right, when so much is still uncertain?

How can we be sure that these increasingly desperate measures will work at all? We’ve been trying most of them for well over a decade, to very little avail. The best we’ve managed, claims Summers, is to stop things falling apart by throwing everything but the kitchen sink at monetary expansion and oscillating between stimulus and fiscal tightening (mostly the latter) as political preference dictates. The end result is a somewhat frightening sense, as the IPPR recently pointed out, that when the next crisis hits there will be neither fiscal nor monetary room for manoeuvre.

In our latest CUSP working paper, I explore the dynamics of this emerging ‘post-growth challenge’. I believe it demands both a deeper understanding of how we got here and a wider palette of colours from which to paint the possibilities for our common future. The paper examines the underlying dynamics of secular stagnation, on both the demand and the supply side, and discusses its relationship to labour productivity growth, rising debt and resource bottlenecks.

The toughest element in this challenge, not yet fully addressed on either the political left or the right, is the relationship between declining growth and social equity. The coordinates of inequality are now plain to see in the stagnant wage rate and declining living conditions of ordinary people. ‘Thousands upon thousands’ of people flocked to this year’s TUC march in London, making it abundantly clear that persistent inequality is threatening political stability. According to TUC general secretary Frances O’Grady ‘there is a new mood in the country; people have been very patient, but now they are demanding a new deal.’

We have addressed the mathematics of this relationship in depth elsewhere. What we found was unexpected. The rising inequality that has haunted advanced economies in recent years wasn’t inevitable at all. Nor is it inevitable in the future. The problem lies, as I argue more specifically in this paper, not in secular stagnation itself but in our responses to it. Specifically, I suggest that rising inequality is the result of our persistent attempts to breathe new life into capitalism, in the face of underlying fundamentals that point in the opposite direction. Our growth fetish has hindered ecological innovation, reinforced inequality and exacerbated financial instability. Prosperity itself is being undone by this allegiance to growth at all costs.

What’s clear now is that it’s time for policy-makers to take the ‘post-growth challenge’ seriously. Judging by the enthusiastic reception from the 900 or so people who attended the première of System Error in Berlin, such a strategy might have a surprising popular support.

Links

- Jackson, T 2018: The Post-Growth Challenge: Secular Stagnation, Inequality and the Limits to Growth. CUSP Working Paper No 12. Guildford: University of Surrey. Read the full paper.

- For more information about the SIGMA model, please see the SIGMA theme page.

Image (CC-BY 2.0) Mural by BLU / blublu.org; Photo (derivative of) Lord Jim / Flickr. This blog first appeared on the CUSP website on 13 May 2018.